reverse tax calculator formula

Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a. Net Income - Please enter the amount of Take Home Pay you require.

Javascript 70 30 Tax Reverse Calculation Get Products Original Amount Without Tax Stack Overflow

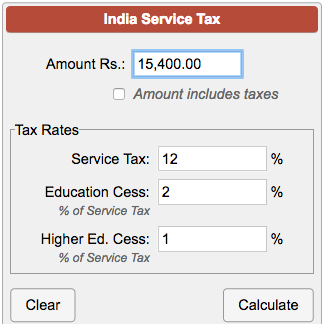

Calculates the canada reverse sales taxes HST GST and PST.

. The reverse sale tax will be calculated as following. 0 6 1. Instead of using a sales-tax calculator you use whats jokingly called a sales tax decalculator The formula is fairly simple.

Divide your sales receipts by 1 plus the sales tax. I appreciate it if. Do you like Calcul Conversion.

Net Sale Amount. The formula to calculate the reverse sales tax is Selling price Pre-tax price final price Post-tax price 1 sales tax. Pre-tax price Final price 1 Sales tax rate For example if the final price of an item is 25.

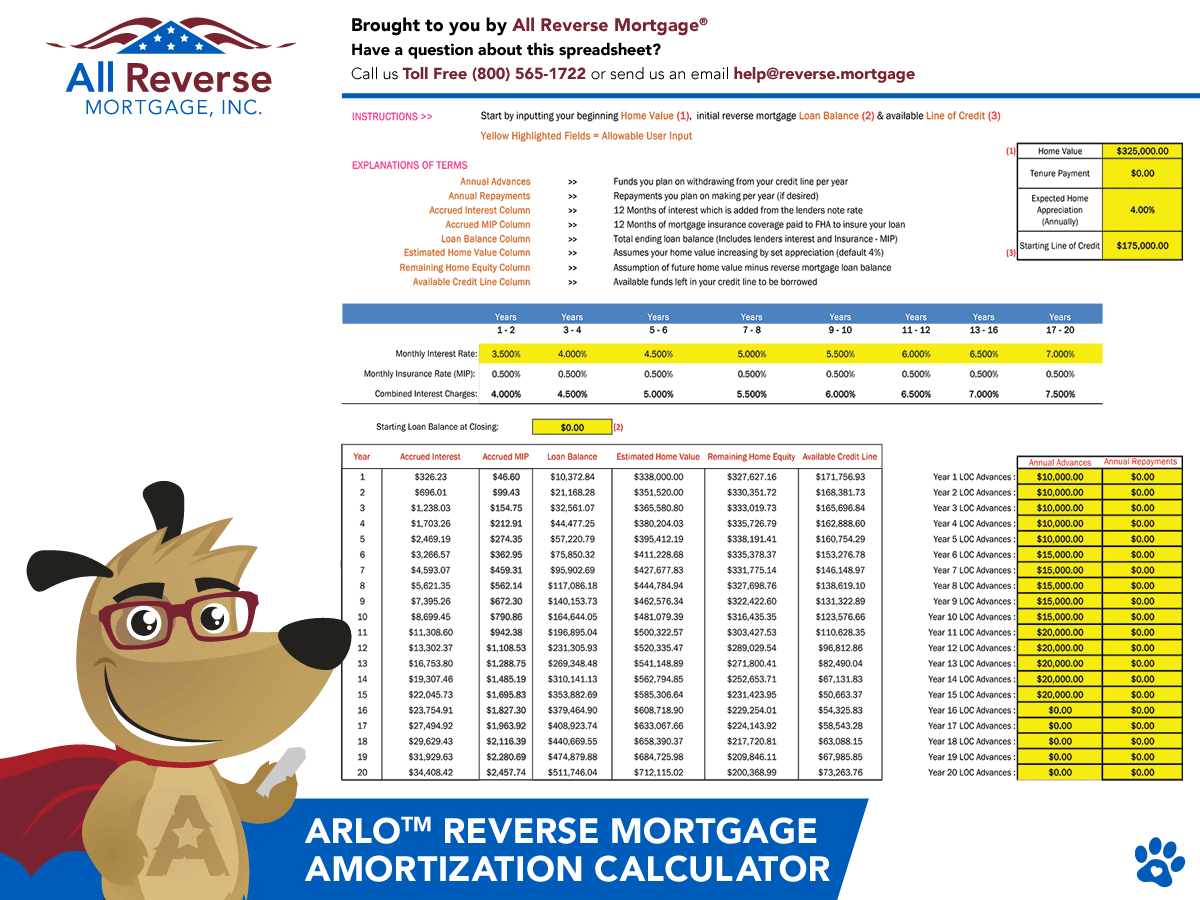

Tax reverse calculation formula. Reverse Sales Tax Computation Formula. Get Started Today and Build Your Future At A Firm With 85 Years Of Investment Experience.

Formula for reverse calculating HST in Ontario. The GST rate was decreased from 7 to 5 between 2006 to 2008. After 1996 several provinces adopted HST a combination of PST and GST into a single value-added tax.

Notice my main language is not English. 1 006 106 1006 106. We have just released our Reverse Tax Calculator which calculate net after tax earnings to gross before tax earnings.

Divide the final amount by the decimal to find the original amount before the percentage was added. Therefore a 750000 prepayment 75 of 1000000 is due on January 20 2016After month end the business determines that January 2016s actual total tax liability. You can calculate the reverse tax by dividing your tax receipt by 1 plus.

Reverse Sales Tax Formula. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. 06 r6 100sum p5q5 p6 o6p5.

Thus you can compute the actual price and the sales tax charged on it out of a products post-tax priceThe formula for computing the actual sales. 1 0. This is the NET amount after Tax the.

Reverse Sales Tax Calculations. Tax Amount Original Cost - Original Cost 100100 GST or HST or PST Amount. Tax Year - Select the Tax Year to calculate tax years start 6th April and end 5th April.

Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Formula s to Calculate Reverse Sales Tax. PRETAX PRICE POSTTAX PRICE 1 TAX RATE.

Amount with sales tax 1 HST rate100 Amount without sales tax. In this example work. If you know the final price and the sales tax rate the formula for calculating the pre-tax price is.

The invoice bill to the customer will be 105000 100000 5000 and it is known as the total sale include tax. Calculate the canada reverse sales taxes HST GST and PST. Amount without sales tax x HST rate100 Amount of HST in.

Here is how the total is calculated before sales tax. Amount with taxes Canada Province HSTQSTPST variable rates Amount. X 100 Y result.

You can use tax rates from 2013 to 2002 and specify. To make things simple you can also depend on the reverse percentage calculator.

Sales Tax Calculator Reverse Sales Tax Calculator Finmasters

How To Calculate Sales Tax In Excel

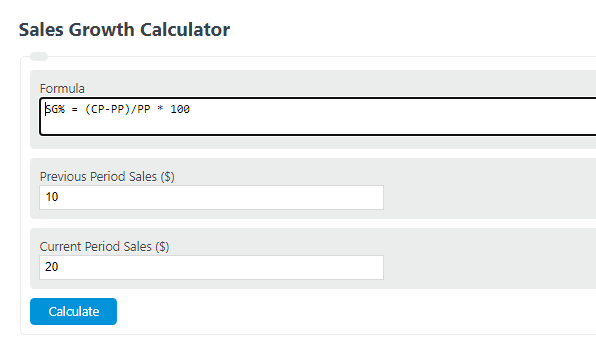

Sales Growth Calculator Calculator Academy

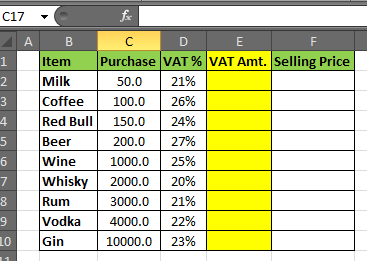

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

Pre Tax Income Ebt Formula And Calculator

How To Calculate Sales Tax In Excel

Texas Sales Tax Calculator Reverse Sales Dremployee

Reverse Sales Tax Calculator 100 Free Calculators Io

Reverse Sales Tax Calculator Calculator Academy

Income Tax Formula Excel University

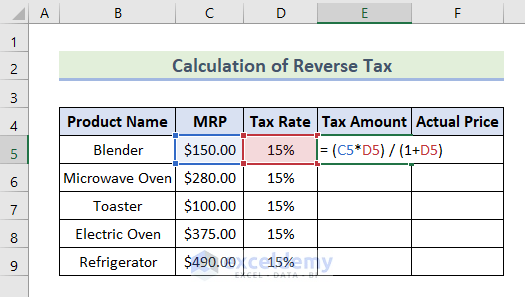

Reverse Tax Calculation Formula In Excel Apply With Easy Steps

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

Sales Tax Calculator Price Before Tax After Tax More

How To Calculate A Reverse Percentage What Is The Formula Quora

Sales Tax Calculator Price Before Tax After Tax More